Personal taxation is a prevalent subject. Simply stated, tax refers to paying a certain amount of our income to the cabinet or the government, which is then used to enhance construction and the full development of the nation. The information about the tax cycle and economics is very crucial to understand the basics of personal taxation. However, practically and technically, personal taxation is a complex domain for students. To eliminate the risk of scoring low grades, the students search for Personal Taxation Assignment Help experts who can provide their quality solutions within the deadline. Are you searching for the best quality Personal Taxation Assignment Help at an affordable price? Our expert team is highly skilled and has years of experience with in-depth knowledge about the concept of taxation and all other associated topics. They cover topics such as tax law, taxation of salary, corporate tax, and so on.

Taxation refers to a type of duty imposed on the general public either by a state government or by the central government depending upon the income of an individual. The revenue that the government gathers after taxation is utilized to develop the nation and other several legislative issues. Other areas where gathered revenue is utilized are educational institutions, healthcare assignment systems, social engineering, and so on. It is also closely linked with economics because both subjects deal with the nation’s economy.

Every nation has different taxation methods and kinds of taxes. For example, countries such as Canada, India, and the US, have centralized taxes levied by the central cabinet authorities and local taxes imposed by the provincial cabinet authorities. There are several kinds of taxes, a few of which are discussed below:

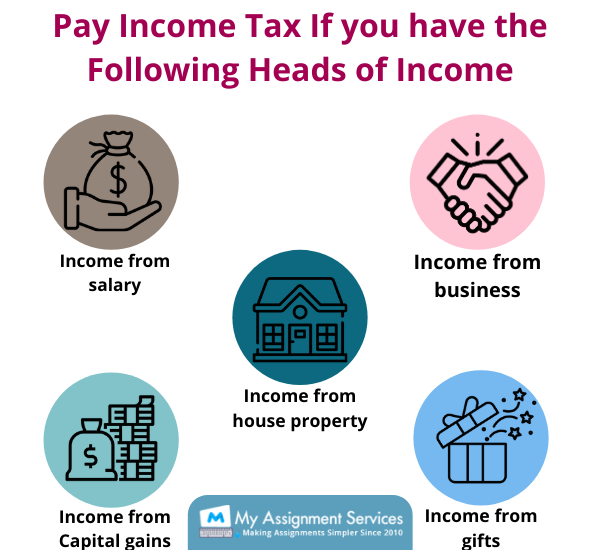

This tax is gathered based on an individual’s income. If an individual fails to pay the required tax, it is regarded as an unlawful practice, and the person has to suffer punishment from the law.

This tax is imposed on an individual seeking profits from any deceased individual’s assets.

This tax is submitted indeed by the property proprietor to the legislative authority.

Toll tax is usually levied on certain private or public roads which helps the cabinet or the owners and investors to maintain the manufacturing production of the road.

According to our Personal Taxation Assignment Help experts, this kind of tax is imposed on the businesses' and organizations’ profits earned.

Our tax assignment papers assessment allows tax experts to say that these kinds of expenses are gathered on the use of the goods, for instance, tobacco, liquor, fuel, and so on.

Online Assignment Help

Custom Essay Help

Dissertation Writing Guidance

In this, either the tax rate charged will be less for the wealthy individual or at par for all the natives. For example, the tax rate of 15% will not create a significant effect on a rich person’s living, while the same tax rate will adversely impact the citizens with low wages.

In this, people with more luxury are required to submit a higher tax rate than the people having lesser wages. Simply stated, a rich person pays more than a middle-class individual, while the middle-class individual spends more than a working-category individual.

Individuals of all income levels are supposed to pay their proportion of taxation. This kind of tax is most commonly known at the state level as compared to the central level.

An individual pays property tax against the buying of land, a home, or any commercial property. While examining the budgeting before buying any asset, one must take care of the tax rate included in the purchase, as it may often enhance the rate of cost substantially.

It causes a significant reduction in your paycheck. For example, if you evaluate your yearly wages and divide the sum by the total number of times you get your wages, the outcome will surprise you. As the number will be more as compared to the paycheck you are enduring.

The tax imposed on the amount being consumed by individuals is not earned by them. Some of its types are sales tax (levied to enhance wages) and excise tax (levied on items like alcohol or gasoline).

Learning all kinds of personal taxation is not an easy task, as it requires intricate calculations and a detailed evaluation of rules and regulations. The universities assign exhaustive taxation assignments to students to evaluate their level of understanding of the subject. They usually evaluate students' knowledge about taxation laws, tax calculations, changes in the rules and regulations, and so on. Students seek Personal Taxation Assignment Help to understand the concept of personal taxation and score good grades. Moreover, here is a sample by our experts to help you evaluate the quality of work that they provide.

Here are some of the exclusive features of My Assignment Services:

Our experts are working on different shifts, covering day and night. You are free to consider our experts at any time. They will provide you with quality personal taxation homework help 24*7

Our experts provide 100% original content to avoid trouble for students. Our experts will deliver a report generated from Plagiarism software.

Our experts are working tirelessly to finish your legal case study writing help orders. They will deliver your solution file within the deadline to help you pass with flying colors.

We offer the best reasonable price and discounts on personal taxation homework help so that maximum students can avail of our service.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeGet

500 Words Free

on your assignment today

Get

500 Words Free

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....

Speak directly with a qualified subject expert.

Get clarity on your assignment, structure, and next steps.

In this free session, you can: