To fund the government, one of the most common ways across OECD is individual taxes. Through individual taxes, they raise revenue to fund the government. For a student of law taxation, a law assignment is one of the difficult assignments. It is a common scenario that the students are looking for the best possible help with the taxation law assignment. Students find it difficult to implement the formulas of taxation. To eliminate this problem My Assignment Services have brought to you the foundation of the taxation of individual assignment help in Canada. From now on you will never miss the deadline of your assignment. Our main objective is to make you achieve your academic goals and make your life stress-free. We also provide the Foundations of the Taxation of Individuals homework help.

We at My Assignment Services provide the highly professional foundation of the taxation of individual assignment help to the students of Canada. Our experts are well aware of the foundation of individual taxation. Although they cover all the topics of taxation for law assignments help, as our experts specialized in the field of taxation law. Here is the 360-degree solution of the best foundation of the taxation of individuals assignment help.

Let's start with the basics. It is very important to know about taxation before starting to work on any taxation law assignment. Taxation is not a thing with which all of you are not familiar. Taxation is paying a part of your income to the government as per the tax slabs, which are further utilized by the government for the welfare and growth of the country.

The money that is collected by the government is in the form of tax and the government utilizes this money to carry out several functions such as educational services, health system, and many other functions that help in the growth of the country.

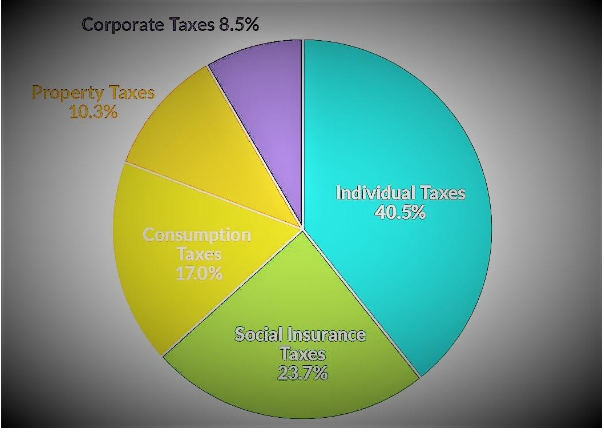

One of the most ordinary ways of raising revenue that is used to fund the government is individual taxes. The income tax of individuals is imposed on the income of an individual or income of households which is used to fund government operations. The income tax of an individual is progressive in nature. This means that the more an individual earns the more income tax he has to pay.

Countries also have payroll taxes. These taxes are imposed on wage income. Payroll taxes are in addition to the general income tax of an individual. The revenue generated from payroll taxes is specifically allocated toward social programs (insurance). Social insurance programs like government pension programs, unemployment insurance, health insurance, etc.

One of the leading independent non-profit tax policies of the nation since 1937 is the tax foundation. The main objective of the tax foundation is to improve the lives of the people and improve economic growth and provide more and more opportunities to the people through tax policies.

The income tax of an individual is imposed at the federal level. The income tax rates in Canada range between 15 to 33 percent. These rates are applied to income ranges and such income ranges are known as Tax brackets. Following are the tax bracket:

Online Assignment Help

Custom Essay Help

Dissertation Writing Service

One of the most complex assignments faced by students in their student life is taxation law assignments. Students often face difficulties in understanding the question for their assignments given by their professors. This is one of the major reasons that they look for the foundation of the taxation of individual assignment help.

Sometimes students have poor problem-solving skills as they do not have proper knowledge of the assigned topic of their assignments. Several students do not even know what the question is exactly.

Students are always given a definite time to finish their assignments by their professors. According to the survey, most of the students miss the deadline for submitting their assignments because of poor time management.

Now there is no need to worry, My Assignment Services will solve all your problems and make your student life easier, so you can spend time doing what you love. Get your Foundations of the Taxation of Individuals homework help now.

Once we all were students and thus we know and understand how hard it is for students to manage work and studies. That is why we are providing the foundations of the taxation of individuals' assignment help at a very nominal rate so that it is accessible to everyone. So that finance will not be a concern anymore. We want you to focus on your assignment and homework. We want you to spend your time doing things that you love. Remember time is important.

Our experts are available round the clock for your help. You can contact us at your convenience. We provide the best foundations for the taxation of individual assignment help and homework help at very affordable prices.

Our top academic portal My Assignment Services works hard to serve matchless learning guidance and perfect assistance to numerous students residing across various parts of the globe. We deliver the services that a scholar directly needs and allow them to enjoy academic distinction and top-notch grades by seeking the best Foundation for the tax practice assignment help. Your class level or assessment's difficulty level never matters for us because we own capabilities of delivering services precisely as per the requirements of scholars.

We have more than 1000 professional writers that are here to help you in different fields of academics. And that is why we assure you to deliver the best foundations of the taxation of individuals' homework help.

The experts of my assignment services start everything from scratch and at last examine the whole document with a plagiarism checker. We also send you a plagiarism report to assure you that the content is 100 % authentic.

Our objective is to get our reach to every student and we know that students are mostly low on a budget which is why our law assignment help is available at pocket-friendly prices.

You can contact us anytime according to your convenience. We will be available round the clock for you.

Boost Your Grades By Getting The Foundation Of The Taxation Of Individuals Assignment Help Now

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeGet

500 Words Free

on your assignment today

Get

500 Words Free

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....

Speak directly with a qualified subject expert.

Get clarity on your assignment, structure, and next steps.

In this free session, you can: