Highlights

Public Economics deals with the economics of the public sector. It is concerned with the process of analyzing the government's economic policies with the efficiency to meet the economic goals and the dispensation of wealth equally. It provides information about the role and relevance of government in the economic markets. It requires students to possess a deep understanding of all aspects of economic principles to find out the relevance of government practices in economic markets which eventually helps in determining the trade-off between government involvement and the lack of it. However, studies have shown due to the intricacies involved in the subject, many students are stressed and face difficulties in completing their assignments. If you are one of those students, Public Economics Assignment Help is your saviour. My Assignment Services is one of the most prominent assignment helper and provides quality Public Economics Assignment Help.

The domain of public economics deals with the role of the government and how its activities affect the economic market. Public economic theory is a thesis established after the theory of welfare economics and adapted as an effective technique in the community. Its objective involves the enhancement of social welfare and increases the growth of an economy. The domain permits the sellers to construct policies stating the role of government in economic markets. It also allows sellers to explain the extent of companies, enabling them to participate in several economic activities.

The theory of microeconomics regulates public economics supporting a business to determine its profit earned from independent trade. Microeconomic theory evaluates the risk involved within a company and predicts an output based on inputs or capital invested by a business. This theory determines and predicts the expenditure and taxation by the government without any intervention from the government. Public economics study involves several factors like market setbacks, external practices, and the enhancement and intervention of governmental policies. It also permits sellers to fix public plans and determine government taxation and expenditures.

Online Assignment Help

Custom Essay Help

Dissertation Writing Guidance

Public economics is an important part of economics concerned with the financial situation of the state involving its expenditure and revenue. It also looks into the method of financing several ways of public wares and services, together with tools of amassed revenue. It is usually utilized in a mixed economy where an individual contributes to most of the decision for their activities but very often cabinet policies affects an individual activity to target equilibrium which was not present beforehand.

Public economics is also crucial in several areas for instance security to the lessening of inequalities, improvement of infrastructure, entrepreneurs, economic growth, and so on. Hence, public economics is an important and primary need of consideration for any policy inventor, or government to set its wages and investment interventions.

Public economics is concerned with when and to what extent the government should step into the economy of the nation to state market failures. Some of the government interventions are:

Ethical public goods, or gathered consumption goods shows two possessions that are non-excludability and non-rivalry. Non-rivalry means if an individual's consumption does not deprive the needs of the other individuals and non-excludability stands for the condition in which the utilization is not limited to a certain number of people. Due to these two properties, it is stated that without interventions, markets will not able to produce an effective amount.

It forms when utilization by an individual or manufacturing by an organization affects the consumption or production of other individuals or organizations. There are positive externalities such as education and public health and also negative externalities such as noise pollution, air pollution, and non-vaccination. A positive externality is defined as the money invested in private areas to enhance the quality of surroundings whereas negative externalities are defined as the industry that demolishes the convenience state of people living in neighbouring sites.

Imperfect competition can occur in varying forms within the market and is often based on the barriers to organization profits, entry, and manufacturing targets and the creation of the product and other associated markets. Imperfect competition within the market leads to a social cost and it is the sole duty of the government to decrease or minimize the cost.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

All the revenue gathered and transactions of the cabinet itself dominate the governance of inequality. In the high differential cases like that of Airbnb, the cabinet imposes high taxes on profit, income, and properties of the rich population. The cash gathered is used to provide support to the poor through subsidies and other direct and indirect services involved. Public Economics Homework help will let you gain knowledge about this portion of economics in detail.

The cabinet is dependent on public finance as the most prominent device to conquer the consequences of deflation and inflation. When concerned with inflation, it decreases the nominal expenditures and indirect taxes but enhances direct expenditures and taxes. Also, it gathers public debt inside and enhances investment. On the other hand, the policy is changed in the example of deflation.

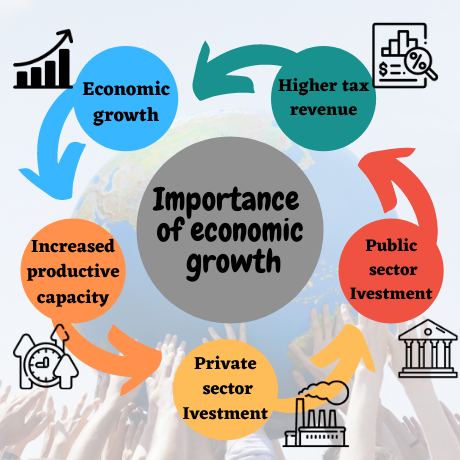

The government of a country must idealize its finance adding to the renewable growth of the nation. To confirm the steady economic growth, the cabinet is dependent on fiscal devices to enhance the demand and supply of the product. The techniques utilized in activities are public debt, taxes, and state expenditure. Public economics assignment help explains the importance of economic growth to help students understand the significance of public economics.

Macro and microeconomics devices permit the cabinet of a country to maintain a balance in its economy. For success, the cabinet is committed to providing higher taxes and enhancing the internal public debt. The amount gathered is utilized to repay debt stated by foreign countries and maintain the financial condition of the economy. Also, concerning recession, the process is changed and often reversed, managing the economic status of the country.

Public economics assignment involves the analysis of federal government tax and expenses. Students are required to know about multi-subject topics consisting of externalities, market failures, and the execution and production of the federal government. A single mistake leads to a reassessment procedure which is often very time-consuming and even after that students are not able to prepare quality public economic assignment solutions. Hence, Students seek Public Economics Assignment Help at an affordable price which can provide them with quality solutions on time. Moreover, Experts at My Assignment Services experts have brought to you this sample question to help you assess the standard of the work they provide.

Experts at my assignment services acknowledge the difficulties that students face while completing their Public Economics homework. Our experts will assist you to overcome and obtain high grades by facilitating you with multiple features. Here are some of the features you will get by ordering with us:

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeGet

500 Words Free

on your assignment today

Get

500 Words Free

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....

Speak directly with a qualified subject expert.

Get clarity on your assignment, structure, and next steps.

In this free session, you can: