Capital market is a sub-branch of finance. Ideally, the financial system comprises several complex mechanisms and institutions, which impacts the generation of savings and their transfer to those who will invest. It is constructed based on all those mediums via which savings become accessible for investments. Students studying capital markets as a course unit are required to learn the main elements of the financial system, such as financial assets, financial intermediates, and financial markets and prepare time-bound assignments. Several students find it difficult to understand financial elements and capital markets dimensions. Are you also one of those and looking for Capital Markets Assignment Help in Canada? Well, you’re at the right spot. Experts at My Assignment Services provide the best quality solutions to students. Let’s look at distinct Capital Market topics we have covered over the past ten years.

Capital Markets are grounds where investments and savings are directed between the providers who have resources and those in need of resources. The organizations that have resources comprise institutional and retail investors, while those who want resources are governments, businesses, and individuals. It is primarily composed of two types of markets, namely, primary and secondary markets. The most customary markets are the bond market and the stock market.

Capital markets operate to enhance transactional productivity. These markets function to bring those who have resources and those seeking resources together and issue a ground where organizations can interchange securities.

They involve suppliers and users of funds. Suppliers involve the institutions and households providing them- life insurance companies, pension funds, non-financial companies, and charitable foundations- that produce money beyond their investment requirements. Users of funds involve a motor vehicle and home buyers, cabinets financing constructing funds, and functioning expenses.

Our experts, who provide Capital Markets homework help to students, will now discuss the functions of the primary market followed by the objectives.

These markets are available for certain investors who purchase securities straightaway from the issuing institutions. These securities are regarded as initial public offerings (IPOs) or primary offerings. When a business migrates to the public, it trades its goods and bonds to institutional investors operating at a large scale like mutual funds and hedge funds.

It is defined as processing, evaluating, and examining new project programs in the primary market. It initiates before an issue is assigned in the market. It is completed using commercial bankers.

For the growth of brokers, dealers, and suppliers are provided job administration who straightaway contact with investors.

These are the grounds overseen by a controlling unit like the Securities and Exchange Commission (SEC) where already issued or existing securities are traded between investors. Issuing institutions do not play a role in the secondary market. Secondary markets play a crucial role in capital markets as it generates liquidity, providing shareholders with the strength to buy securities.

Systemic data about the costs of security

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

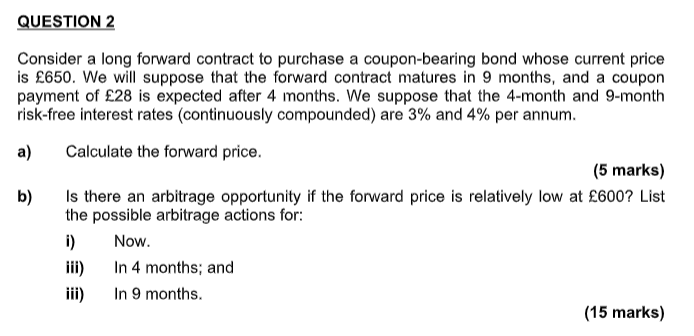

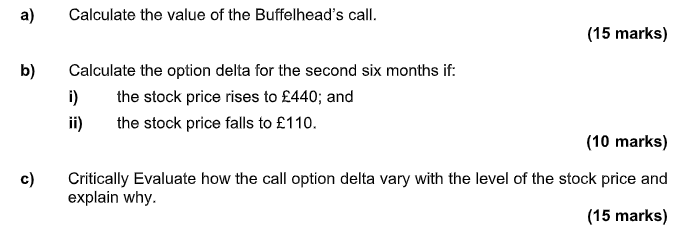

Capital market assignments often consist of evaluating the capital growth at the global market. It also requires determining the capital market’s role for investors in pooling their costs in the business market and much more. Most of the students are not aware of the steps required in writing capital market assignments due to insufficient research papers and hence, seek Capital Markets Assignment Help in Canada. Also, it is challenging for students to write assignments due to lack of time and lack of enthusiasm from universities. Moreover, here is a sample that has been provided by experts to help you evaluate the quality of work that they provide.

Online Assignment Help

Custom Essay Help

Dissertation Writing Service

Writing a capital market assignment is not a joy of joy. Students are required to gain in-depth knowledge about the trading system, financial elements, and types of the capital market, and so on. My Assignment Services experts provide the following opportunities:

Plagiarism-free work guaranteed: Our experts provide unique content with no plagiarism. You will get a report generated from Plagiarism software to help you evaluate the rate of plagiarism.

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeGet

500 Words Free

on your assignment today

Get

500 Words Free

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....

Speak directly with a qualified subject expert.

Get clarity on your assignment, structure, and next steps.

In this free session, you can: