Accounting is considered to be the backbone of the business industry. Students pursuing education in variance accounting are required to possess a few standards for the sake of assuring an excellent future in the corporate world. Moreover, the wide range of accountancy has provided various opportunities for students. With enhancing demand of a business and financial value, the information is needed to be protected and technology aids in it on a large scale. Are you struggling with your Variance Accounting Assignment and wondering who can help you at an affordable price? Well, don’t worry an elite help service is here to back you up. Variance Accounting Assignment Help online from My Assignment Services experts helps students to obtain a better understanding of variance accounting and its associated problems. Our Variance Accounting Assignment experts provide the best quality solutions so you can pass with flying colours.

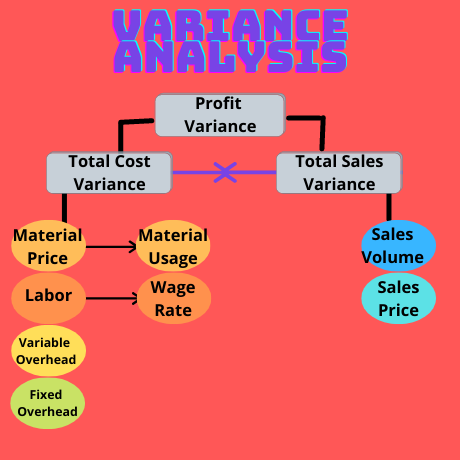

Variance accounting is generally called variance analysis. It is the field of financial accounting in which the understanding of the tactics and principles of variance is taught to scholars. Variance can be defined as the difference between the anticipated roughly computed budget and the actual budget. This helps review the budget of the company or a business for the short term. It is based upon several factors such as manpower, cost of raw materials, fluctuation in the competition, unexpected increase or decrease in the demands, and several other natural factors such as floods, rain, a contingent of the pandemic, etc.

The variance accounting was used by the Egyptians for managing and budgeting the cost and revenue of their provinces effectively. It was used as a budgetary control tool with the help of reviewing the working ability of employees and the expenditure of the raw materials.

Variance accounting is firmly not easy to understand for many students living and learning in Canada. Students are frightened due to the countless calculations involved in variance accounting assignments. Our assignment experts admire the difficulties that students are facing while solving variance accounting assignments. Few of them are complex calculations; the time required for solving this calculation requires sharp analytical skills. Moreover, here is a sample that has been provided by our experts at My Assignment Services that avail Variance Accounting Assignment help online.

Online Assignment Help

Custom Essay Help

Dissertation Writing Guidance

The solutions provided by our experts that avail Variance Accounting Assignment Help online received a High Distinction.

Our experts offer multiple advantages apart from removing the load from your shoulders. With our Accounting Assignment Help Online, we provide students with quality material to help them learn about the various concepts of accountancy. The students are facilitated with the following benefits if they avail of My Assignment Services Variance Accounting Assignment Help.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeGet

500 Words Free

on your assignment today

Get

500 Words Free

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....

Speak directly with a qualified subject expert.

Get clarity on your assignment, structure, and next steps.

In this free session, you can: