Corporate governance accounting is not an easy concept as the broad range of legal rules, statutes, processes, regulations, and mechanism that has authority to manage large corporation units are maintained through central government companies. To finish corporate governance accounting assignments, students need detailed information about corporate governance accounting. However, corporate governance is a broad topic and has huge intricacies associated with it as students have to memorize several laws and statuses. Even after learning those laws students find it difficult to interpret status. Thus one can say corporate governance accounting homework is hard to accomplish because of the complexity of the topic. Are you one of those who are struggling with corporate governance accounting assignments? Well, My Assignment Services is offering students accounting assignment help, which you can enjoy and experts will deliver the best quality solution on time.

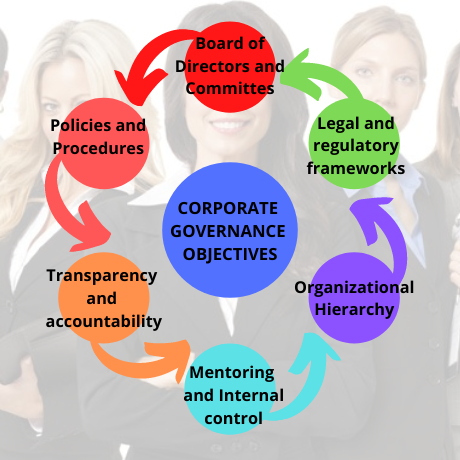

Law is known as the set of rules and regulations for the people of a specified organization or country that evaluates and manages their actions which can be restrained through the imposition of defined sanctions. The constituency or the federation is the second area of law that differs across the world regarding rules and guidelines. One of the most perplexing portions of law is the course of corporate governance accounting. Corporate governance is an assortment of rules and regulations that controls a business and also deals with the obligations, regulations, rights, and responsibilities of the company’s entity. It also involves shareholders, stakeholders, management, government, and all other concerned authority.

An accountant plays an important role in corporate governance; they help in clarifying liquidity and accountability about the daily activities of businesses and companies. Accountants are responsible for sharing accurate data about the organization not only to the shareholders but also to the stakeholders. They play an important role in building the image and trust of the company in front of stakeholders. The major role of the accountant in corporate governance is two-old. The primary is to review the flow of cash in and out of multiple departments and analyze the activities done with the cash and also all the investment details. The second is to clarify a clean framework of liquidity and accountability to anticipate the interests of stakeholders.

A detailed explanation of the scope of an accountant in corporate governance is given below.

Disclosure of all the information helps to enhance the stakeholder's understanding of an organization's working structure and practices, its defined policies, and its accomplishments. Disclosure does not involve any unauthentic cost burden on the enterprise. Moreover, companies are allowed to share information to some extent to prevent their competitive position in the market. The accountant displays the required disclosure of all accomplishments that are caused between the regular proceeding intervals. They also ensure high-quality works are represented in front of stakeholders to help them monitor the company structure, which in return ensures transparency.

Online Assignment Help

Custom Essay Help

Dissertation Writing Guidance

Accountants are very convenient when governance compliance needs help to plan strategies. Companies can perform exceptionally by planning effective strategies based on the data made available by an accountant. They can make clear-cut tough decisions such as where to invest, how to function effectively when to invest, and also how much such that stakeholders are also content.

A company's brand is held responsible to the public in various ways. They should encounter their companies’ obligations like paying varying taxes to the public. Stakeholders invest in companies based on their financial position of companies. Accountants are responsible for sending precise information to stakeholders. They also have to determine any false practices if underlying within the company to ensure that no unauthorized finances are presented to the public.

Shareholders are institutions that purchase at least one share of a business. Shareholders are co-owners of businesses and the businesses are accountable to them as they provide financial support. Based on the data available shareholders take various decisions like increasing or decreasing investments, or taking actions against varying practices that lead to companies' loss.

Accountants plan the long and short-term needs of an organization. Managing a healthy cash flow within an organization is the most crucial duty of an accountant. An overview of the cash that is in hand helps in evaluating the financial decisions.

Financial reporting involves documentation of finances to investors whereas internal management is done in management reporting. Accountants handle both the processes of the state to report precise statistics. Financial reporting depicts valuable insights to stakeholders, wherein management reporting involves an internal state of affairs in the company.

Students studying management find the corporate governance assignments a little dreadful. The various issues that were faced by students are corporate accounting requires detailed knowledge about finance law and statutes within a company, information about cash flow, structure of management, and financial reports. An accountant plays a vital role in the company and hence students seek experts in corporate governance accounting homework help. Experts provide solutions that consist of terminologies of corporate governance in simpler words and help students help scoring desired grades in academics. Moreover, here is a sample of corporate governance accounting assignment by our experts.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

Here is the solution to the sample question:

Well, corporate governance accounting assignments are written by highly skilled experts at My Assignment Services. Here are some of the reasons that make us the best in the branch to get corporate governance accounting assignment help.

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeGet

500 Words Free

on your assignment today

Get

500 Words Free

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....

Speak directly with a qualified subject expert.

Get clarity on your assignment, structure, and next steps.

In this free session, you can: